What is Motorcycle Finance?

Motorcycle finance helps you spread the cost of a new or used motorcycle. Instead of paying the full amount upfront, you can pay monthly with interest. Black Horse offer a range of financial options to allow to get out on the road with a payment plan flexible to your needs, with different preference options available for your circumstances, such as Personal Loan, Hire Purchase and Personal Contract Purchase (PCP).

The Products

Each of these products works a little differently, but in general terms, the finance company will buy the motorcycle on your behalf and then you will repay the amount borrowed, plus interest - when you have paid the final repayment the motorcycle will be yours. The exception is Personal Loan where you own the motorcycle from the outset.

Your Options

The choice is yours:

- Own the motorcycle from the beginning of the agreement as in the case of a Personal Loan.

- Own the motorcycle at the end of the agreement.

- Or ride a new motorcycle for a set term, handing it back at the end. This is an option under Personal Contract Purchase (PCP).*

Repayment Duration

Dependant on the product you choose, you would typically pay a deposit and make monthly repayments from 1-5 years to tailor the finance to meet your budget. Where the product is secured against the motorcycle for the duration of the agreement (not in the case of a Personal Loan) the motorcycle will be owned by the finance company (not the dealer). You do not take title of the motorcycle until the final repayment is made.

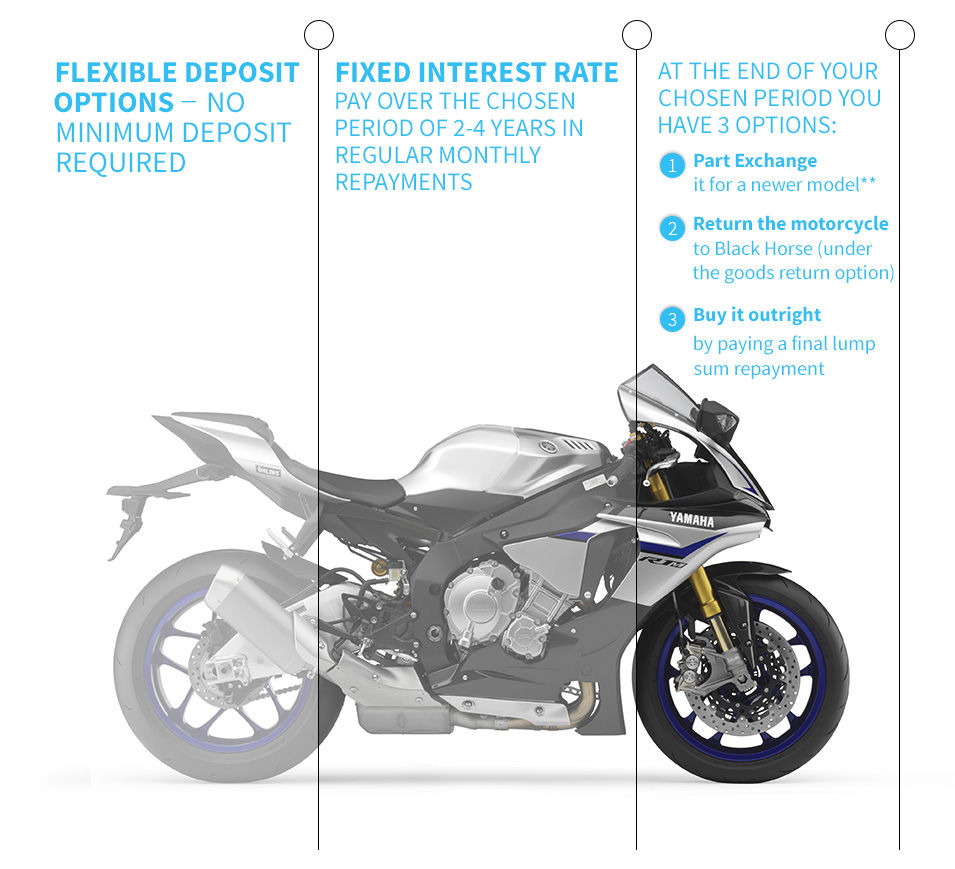

* Under our PCP product, you have the option at the end of the agreement to return the motorcycle and not pay the final lump sum repayment. If the motorcycle is in good condition and has not exceeded the agreed maximum mileage you will have nothing further to pay. Further information on what is considered good condition can be found at blackhorse.co.uk/BikeConditionGuide. If the motorcycle has exceeded the agreed maximum mileage a charge for excess mileage will apply.

PERSONAL

CONTRACT

PURCHASE (PCP)

With Black Horse Personal Contract Purchase you can keep your monthly repayments lower by deferring a significant proportion of the amount of credit to the final repayment at the end of the agreement. Agree an initial deposit, how many miles you are likely to ride each year and how long you want the agreement to run for and the dealer will then calculate the Guaranteed Future Value (GFV) of your motorcycle and confirm your monthly repayment. The dealer will submit the finance application to us and subject to your application being approved; you can just ride your motorcycle away.

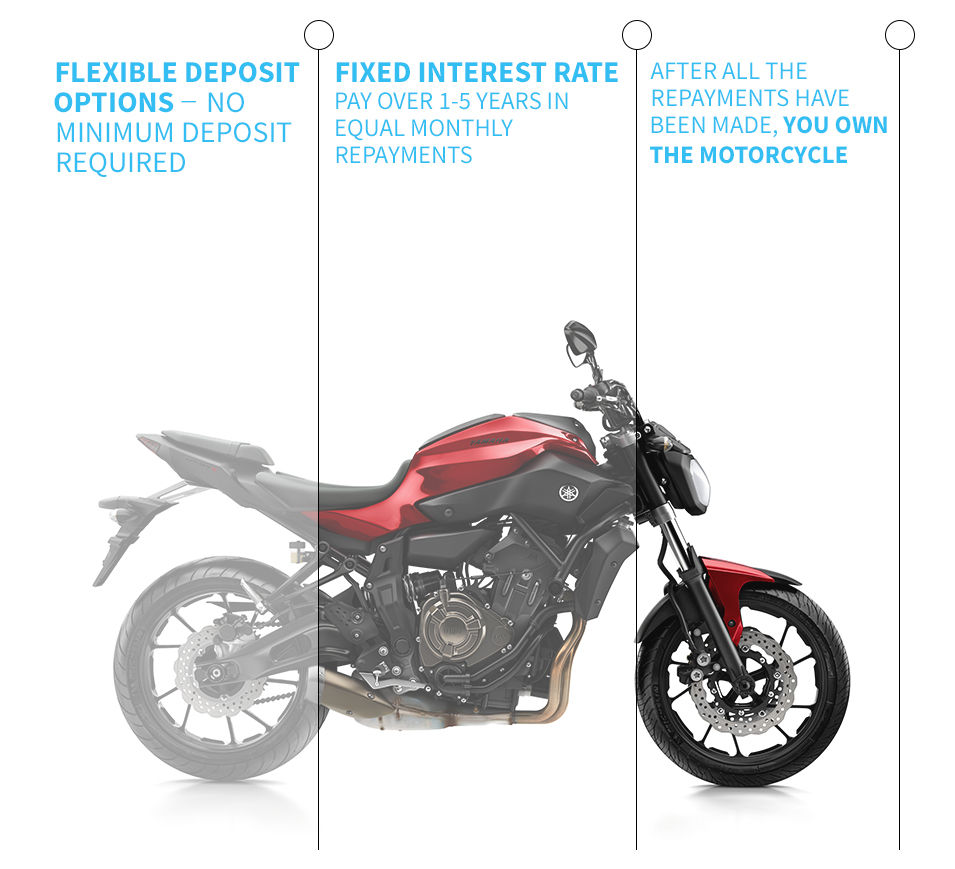

HIRE

PURCHASE

Black Horse Hire Purchase could help you buy the motorcycle you want while spreading the cost. Agree an initial deposit with the dealer and your agreement term and monthly repayment amount, then the dealer will submit the finance application to us and subject to your application being approved, you can just ride it away - after you've made all the repayments including the interest, the motorcycle's all yours.

Sound good?

WHAT IS...

BEING A GUARANTOR?

What does being a guarantor mean?

Being a guarantor involves helping someone else get credit, such as a loan or mortgage. Acting as a guarantor, you “guarantee” someone else’s loan or mortgage by promising to repay the debt if they can’t afford to. It’s wise to only agree to being a guarantor for someone you know well. Often, parents will act as guarantors for their children, to help them take that first step onto the property ladder.

Can anyone be a guarantor?

Almost anyone can be a guarantor. It’s often a parent, spouse (as long as you have separate bank accounts), sister, brother, uncle or aunt, friend, or even a grandparent. However, you should only be a guarantor for someone you trust and are willing and able to cover the repayments for.

To be a guarantor you’ll need to be over 21 years old, with a good credit history and financial stability. If you’re a homeowner, this will add credibility to the application.

Whether you’re considering asking someone to be a guarantor, or you’ve been approached by a family member or friend in need, you need to be aware of the possible financial risks.

WHAT IS...

SUB-PRIME FINANCE?

If you have poor or limited credit or you have had financial difficulty in the past we may be able to offer you finance*, however it may be from a sub-prime lender. Sub-prime finance is not guaranteed and may cost more than finance provided by a prime lender. We will try to obtain finance for you but there is no guarantee. It may be from a sub-prime lender, and if so, the cost of finance may likely be at a higher rate than prime lenders offer.

GENERAL TERMS AND CONDITIONS

Please note you will not own the motorcycle and or scooter outright until all payments are made.

If you default on your finance payments, then the bike may be repossessed by the finance provider.

You must be 18 years or older to apply for finance.

Finance is not guaranteed, and any finance application is subject to a credit check and individual circumstances.

If you require any further information please do not hesitate to contact us.

The finance provider will have their own Terms and Conditions, please contact them directly for further information.

If you would like to secure a finance approval, we would need to complete a credit search and finance application. Please complete an online application form

*Fiveways Motorcycle Centre Ltd is an Appointed Representative of http://automotive-compliance.co.uk Automotive Compliance Ltd, which is authorised and regulated by the Financial Conduct Authority (FCA No 497010). Automotive Compliance Ltd’s permissions as a Principal Firm allows Fiveways Motorcycle Centre Ltd to act as a credit broker, not as a lender, for the introduction to a limited number of finance providers and to act as an agent on behalf of the insurer for insurance distribution activities only.

Fiveways Motorcycle Centre LTD is an Appointed Representative of Automotive Compliance Ltd who is authorised and regulated by the Financial Conduct Authority (FCA No. 497010). Automotive Compliance Ltd’s permissions as a Principal Firm allows Fiveways Motorcycle Centre LTD to act as a credit broker, not a lender, for the introduction to a limited number of lenders, and to act as an agent on behalf of the insurer for insurance distribution activities only.

We are a credit broker and not a lender. We can introduce you to a carefully selected panel of lenders, which includes manufacturer lenders linked directly to the franchises that we represent. We act on behalf of the lender for this introduction and not as your agent. We are not impartial, and we are not an independent financial advisor.

Our approach is to introduce you first to the manufacturer lender linked directly to the particular franchise you are purchasing your vehicle from, who are usually able to offer the best available package for you, taking into account both interest rates and other contributions. If they are unable to make you an offer of finance, we then seek to introduce you to whichever of the other lenders on our panel is able to make the next most suitable offer of finance for you. Our aim is to secure a suitable finance agreement for you that enables you to achieve your financial objectives. If you purchase a vehicle, in the majority of cases, we will receive a commission from your lender for introducing you to them which is either a fixed fee, or a fixed percentage of the amount that you borrow. This may be linked to the vehicle model you purchase.

Different lenders pay different commissions for such introductions, and manufacturer lenders linked directly to the franchises that we represent may also provide preferential rates to us for the funding of our vehicle stock and also provide financial support for our training and marketing. But any such amounts they and other lenders pay us will not affect the amounts you pay under your finance agreement; however, you will be contributing towards the commission paid to us with the interest collected on your repayments. Before we propose you to a potential lender, we will inform you of the likely amount of commission we will receive and seek your consent to receive this commission. The exact amount of commission that we will receive will be confirmed prior to you signing your finance agreement.

All finance applications are subject to status, terms and conditions apply, UK residents only, 18s or over. Guarantees may be required.